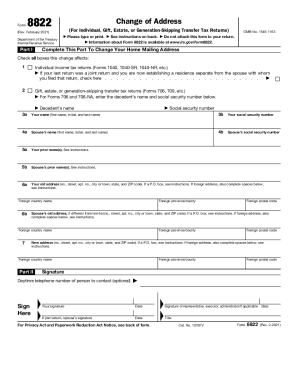

Get the free form 169

Show details

NYC ERS USE ONLY F169 *169* Election of Optional Dispatcher 25-Year Retirement Program Tier 1, Tier 2 or Tier 4 Members This is an election for Tier 1 or Tier 4 members to participate in the Optional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 169 form

Edit your form 169 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 169 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 169 online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 169. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 169

How to fill out form 169:

01

Start by obtaining a copy of form 169 from the relevant authority or organization, such as the government website or your employer.

02

Carefully read the instructions provided with the form. This will ensure that you understand the information being requested and any specific guidelines for completing the form.

03

Begin filling out the form by entering your personal information in the designated fields. This may include your name, address, social security number, and contact information. Make sure to provide accurate and up-to-date details.

04

Proceed to the next sections of the form, which may require you to provide information related to your employment, income, or any other specific details required by the form. Fill in the necessary information accurately and completely.

05

If required, attach any supporting documents mentioned in the instructions or as requested by the form. Make sure these documents are relevant, legible, and properly labeled.

06

Verify that all the information you have provided is correct and complete. Double-check for any errors or omissions before submitting the form.

07

Sign and date the form in the designated area, following any specific instructions regarding signatures.

08

Make a copy of the completed form for your records before submitting it through the designated submission method, whether it be online, by mail, or in person.

Who needs form 169:

01

Form 169 may be required by individuals who are employed or engaged in certain business activities. The specific requirement for this form depends on the specific authority or organization imposing it.

02

Some common examples of individuals who may need to fill out form 169 include employees applying for certain work-related benefits, individuals applying for tax credits or deductions, and businesses reporting specific types of income or expenses.

03

It is important to consult the instructions or reach out to the relevant authority or organization to determine whether you are required to fill out form 169 based on your individual circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is the stagnation increment in Kerala?

Maximum number of stagnation increments allowed will be five, out of which four will be annual and fifth one biennial, subject to the condition that maximum basic pay after adding stagnation increment shall not exceed the maximum of the master scale of Rs. 166800.

What is the undertaking form of spark?

I hereby undertake that in the event of my pay, leave salary or pension or any other item having been fixed in a manner contrary to the provisions contained in the rules, as detected subsequently, any excess payment so made shall be refunded by me to the Government either by adjustment against future payment due to me

What is the rule of increment for govt employees?

"A government servant is granted the annual increment on the basis of his good conduct while rendering one year service. Increments are given annually to officers with good conduct unless such increments are withheld as a measure of punishment or linked with efficiency.

What is the pay scale for Kerala government employees?

Employees who remain in their entry posts in the scales of pay ranging from Rs. 20000-45800 to Rs. 26500-56700 will be granted three higher grades on completion of the above specified periods of service in their posts.

What is the salary increment in Kerala government employees?

The increment rate is above 3% in the lower levels of pay and shrinks to 2.04% while reaching the maximum pay stage. In the revised master scales also, the same trend is continued. The existing minimum increment is ₹ 500 which is converted by applying the multiplication factor of 1.38.

What is the annual increment of government salary?

As per 6th CPC the annual increment has been granted on 1st July of every year and the qualifying period for earning an increment is six months on 1st July. One increment is equal to 3% (three per cent) of the sum of the pay in the pay band and the grade pay will be computed and rounded off to the next multiple of ten.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 169?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific form 169 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete form 169 online?

pdfFiller has made filling out and eSigning form 169 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit form 169 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form 169 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your form 169 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 169 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.